Introducing Hedgey V2

Our newest smart contracts, audited by Consensys Diligence, give onchain token treasuries the most powerful, feature-complete set of tools to launch and manage their orgs like never before.

Visit Hedgey, or the Hedgey App to learn more.

TL:DR: V2 Contract Highlights

Up to 80%+ more gas efficient than current leading alternatives.*

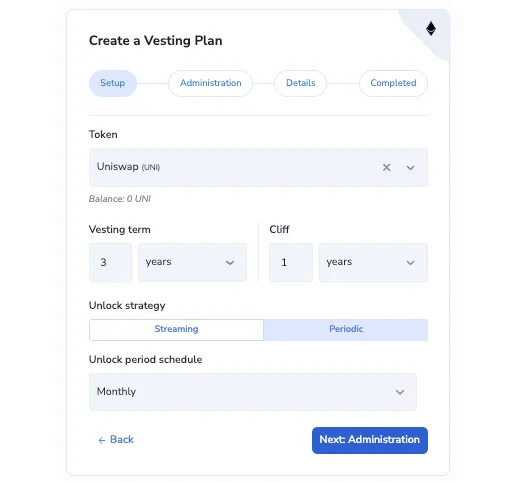

Customizable stream/unlock rate by the second, periodically (weekly, monthly,) or all at once on a specific-date.

Streams/unlocks can be revocable or non-revocable.

Customizable schedules and cliffs on all streams/unlocks

Customizable start dates, including future and past dates.

Revoke active streams manually or with a future end dates.

Optional onchain governance voting with locked & vesting tokens

All streams/locks are still individual ERC-721s.

Revocable streams/locks are non-transferable by recipient (but optionally transferable by issuer admin)

Non-revocable streams can be made transferable or non-transferable

Governance for non-revocable streams/locks can be delegated, partially delegated, and assigned to another wallet with right-to-delegate

Optimized feature sets for token grants programs

Increased onchain admin controls for treasury/finance/grants teams

Optimized Airdrop/Claim products with streaming, vesting, and time-lock feature sets

Safe App optimized

Custodian optimized

Audited by Consensys Diligence.

100% free. Non-upgradable. No admin rights or fee switch.

*Using a revocable 2 year lockup, one year cliff, with periodic monthly unlocks.

Background on Hedgey

Over the last two years, Hedgey has built the core token infrastructure used by some of the best onchain orgs around, including Gitcoin, Celo, Gnosis, Shapeshift, Collabland, BanklessDAO, Protocol Labs, IndexCoop, and many more.

With $77m TVL secured on Hedgey’s contracts, we give onchain orgs free, public goods access to core token infrastructure they need to launch and manage complex token distributions to their team, investors, community, grantees and other key stakeholders.

Our core products include:

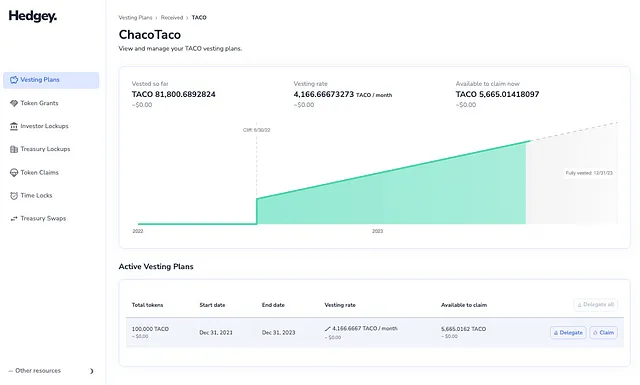

Token Vesting for team members/DAO contributors

Locked token allocations for investors

Token Grant payouts for entire programs

Programmatic treasury unlocks

Airdrops/Merkle tree based token claims.

All of our products are 100% onchain and 100% free. Our products combine secure smart contracts and an industry leading platform to create, track, and manage tokens distributed through Hedgey.

Where we are today.

After working with orgs over the last two years, we’ve gained tremendous insights into what our products did right, and what the orgs we worked with wanted next.

A few key insights from V1:

Governance was key. While we innovated with the first snapshot strategies for token vesting ERC721s, onchain voting is progressively taking over and our solutions had to evolve.

Streaming was still #1 feature, but in addition to linear (every second), many teams need periodic for vesting plans and investor lockups.

ERC721s are a great technology, but shouldn’t always behave like regular NFTs. A decision to make revokable token vesting plans non-transferable in V1 proved to be right.

Admins distributing vesting plans wanted feature sets to better manage their team. (Ex. admin-only transfer options)

In addition to these insights, we learned a lot about the type of platform and dashboards orgs wanted for themselves, their community, their team, grantees, and investors. This led us to build a game-changing product with the contracts for Hedgey V2.

Hedgey V2: The contracts

With Hedgey V2, we took the core of V1 and have packed in the most feature-complete, job-oriented, secure contracts ever built for onchain finance teams in our sector. As of today these contracts are live across our core products.

Efficiency

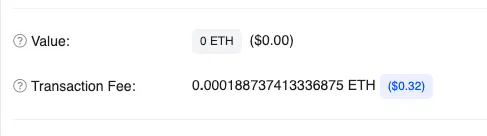

While our linear streaming products remain gas optimized, products using our periodic token lock will experience 80% cheaper transactions for the most common vesting structures. In a baseline comparison of plans with a 2 year schedule, one year cliff, and periodic monthly unlocks Hedgey performed 80% cheaper than other leading alternatives.

Multiple plans can be created in a single transaction. Up to 80 individual for under $1 dollar in gas on some L2s is possible.

Customization

In addition to single-date unlocks and streaming/linear token releases, v2 introduces periodic token unlocks that can be set to weekly, monthly, or custom cadences for unlock events.

All plans include optional cliffs, revocability rights, transferability/non-transferability, and more.

Individual plans created on the same transaction can include unique token amounts and start dates. Start dates can be backdated and future dated.

Control

Issuers can set transferability on or off on locked token plans/streaming (non-revocable.)

Revocable vesting plans (typically issued to team members) are non-transferable. In V2 admins can optionally allow admin-only transfer rights to vesting plans. This allows the multisig admin account to transfer active vesting plans on behalf of recipients. This would be used to recover and transfer vesting plans from wallets should the recipient lose access. This feature can be turned off by the recipient should they wish.

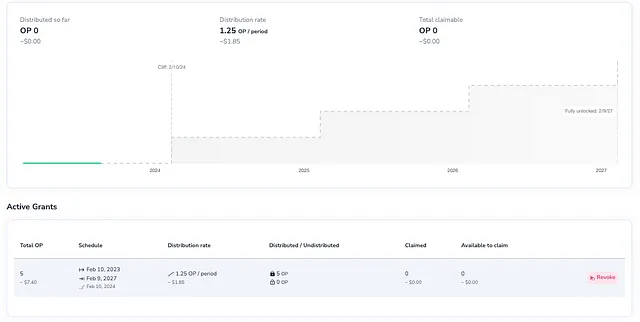

Vested & unlocked tokens become claimable. They are not automatically distributed to the recipient but instead can be claimed at the discretion of the recipient. This gives the recipient increased control into how and when tokens enter their wallet.

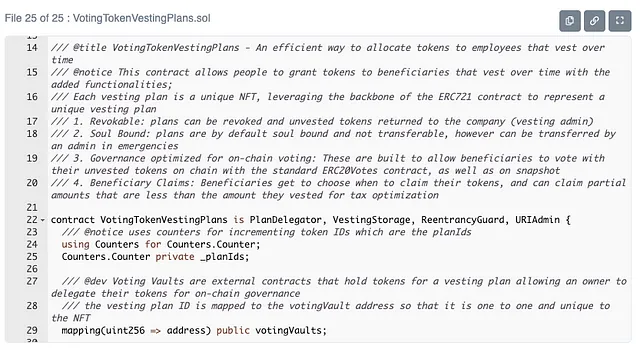

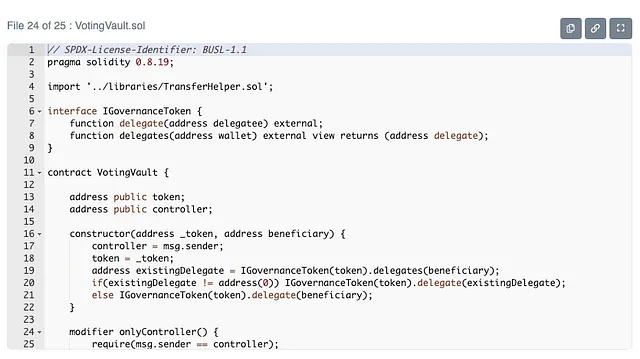

Participation in Onchain Governance

With V2 we release the most comprehensive architecture ever created for voting with locked and vesting tokens.

Locked tokens that are non-revocable can participate in governance directly or be delegated to other wallets. Additionally, ERC721s that represent single blocks of voting/delegation can be separated into multiple ERC721s. This allows for a single wallet to partially delegate or delegate to multiple wallets while keeping assets in a single wallets.

Revocable token plans can participate in governance with the entire amount of their token plan or a partial amount.

In addition to direct delegation to other wallets, recipients can permit another wallet to delegate on its behalf. (ex. VC can keep ERC721 with a custodian while assigning the voting delegation rights to a separate wallet. When tokens need to be re-delegated, the assigned wallet can revoke and reissue voting rights.

ERC721s still at the core

All streams/locks are still individual ERC-721s. These represent ownership of the locked/vesting/streaming allocation. (see notes above on admin controls over restricting transferability.)

Ownership of the locked/vesting/streaming position transfers with the ERC721. This allows selected plans to flexibly move to secure wallets while still being able to interact with vesting plans.

100% Free Public Goods access still at the core

All contracts and the Hedgey platform are free and will remain free to use for all teams and their recipients.

Optimized for Safe and Custodian use

Hedgey has dedicated Safe apps deployed on our core products (with Grants deploying this week)

Our ERC721 standard allows for custodians to hold vesting plans without requiring support for bespoke token escrow contracts.

Security

Hedgey V2 contracts are audited by Consensys Diligence.

Hedgey’s contracts and platform are 100% non-custodial.

Hedgey’s contracts are non-upgradable.

Hedgey’s contracts have no admin rights or fee switch.

What this means for our users

In addition to new features and greater control across the Hedgey platform, you will see a few new products live today and rolling out over the coming months.

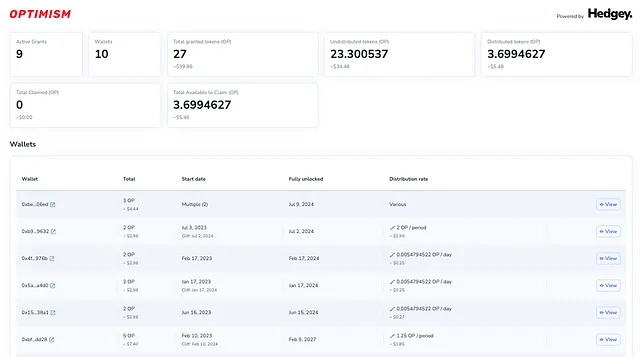

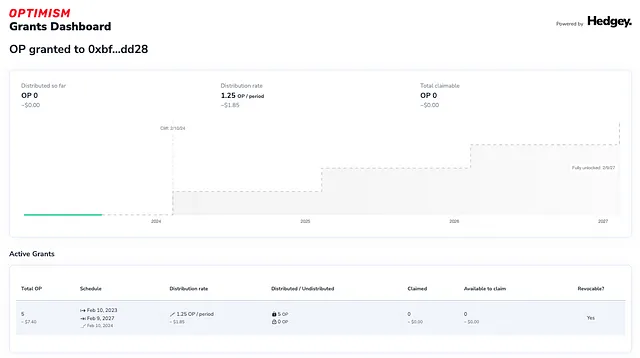

#1 Hedgey Grants

Hedgey Grants was envisioned in large part because of the conversations with existing users. Grants programs want the same control and streamlining in distributions of locked and vesting tokens, while also wanting the transparency in our public dashboards + the ability to give grant recipients not only financial compensation, but the ability to participate in governance with locked/vesting grants.

Hedgey Grants lets orgs distributed locked, vesting, and revocable token grants with the type of control, transparency, and simplicity teams have only dreamed of.

It’s live today and we are thrilled to be showing it to you. (comes available with all of Hedgey’s onchain governance features)

If you run a grants program or want to explore using Hedgey for token grants payouts. Reach out to us.

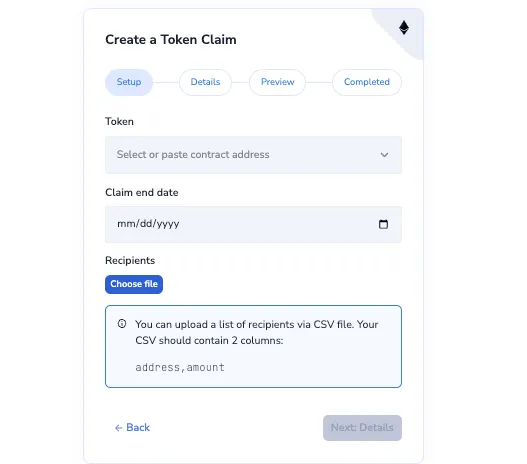

#2 Hedgey Claims

This takes airdropping to a whole new level. With Hedgey claims you can create a whitelist of recipients, # of tokens, and create a personal Merkel tree based claim page where whitelisted addresses can claim tokens. It’s 100x cheaper than airdropping tokens, feature-complete, and live today.

#3 And one more thing…

We want to share a sneak peak at three flagship products coming up in Q1 2024. While our claim page has already been used by incredible orgs to distribute tokens to their community, in its next phase we’ll be introducing three new primitives for how tokens are initially distributed to early communities.

We are proud to share three new products rolling out early next year: Airvest, Airstream, and Airlock.

AirVest

One of the biggest problems facing airdrops is sybil attacks by bots and airdrop farmers. With Airvest that changes.

Airvest will let you distribute tokens to thousands of recipients that are set as locked, non-transferable, and revocable by the assigned wallet (can be a multisig or Governor contract address.) for a preset period of time. During this time, public anti-sybil analysis can be carried out and wrongly allocated tokens can be revoked and returned to the DAO/org.

It’s a powerful feature and if you’re launching a token we would love to share it with you. Schedule time here.

Airstream

Unlocked token airdrops are powerful, but what if there was a tool that streamed tokens allocations per second over the course of years? With Airstream, this becomes possible.

For DAOs, Airstream opens even more possibilities. While tokens are streamed over time, governance rights can be given in full force. This allows you to front-load governance with an early core while progressively decentralizing governance over time

It’s a powerful primitive and we cant wait to show it to you. Schedule time here.

Airlock

Want to build out something radical? Distribute tokens that are locked for a year or longer. Give recipients full voting rights but keep tokens completely locked.

All products will be rolled out in Q1 of 2024

Build with us on V2

Builders welcome. With V1, we collaborated with CollabLand, BanklessDAO, DAOHaus, CollabLand, Guild, and others. With V2 we want to 10x integrations and collaborations.

If you want to build incredible financial products on Hedgey v2 or discuss integrations and collaborations, we want to support you. We will put our full weight into exploring your ideas and bringing them to life. Book a time here.

Deployments

Mainnet and very EVM. If we’re not on your EVM we will be. Send us a dm on twitter.

Links

A closing note on our contracts

Alex, our Cofounder and senior solidity engineer is a corporate finance person to his core. Because of having an extensive background at JPMorgan and on WeWork’s Global treasury team, Alex builds smart contracts the way finance teams need them to be built.

Hedgey’s contracts are simple, powerful, secure, and job-oriented. They are built through countless conversations with real treasury teams at the orgs, foundations, and DAOs that define our industry.

At Hedgey, we start with the problems real humans, at real companies, go through every day and work backwards to solve those problems with onchain technologies accessed through an industry-leading platform. We know our users by name and work to build the features that make their lives better.

These are the contracts, our V2 core, that embodies who we are and how we build. We are so excited to share them with you.

-Lindsey, Cofounder at Hedgey