Case Study: Index Coop DAO (Hedgey Vesting)

Index Coop DAO powers the most groundbreaking structured DeFi products in our space. For their onchain contributor vesting plans, they use Hedgey.

The Challenge:

For DAOs like Index Coop, spending less time on admin work lets them focus on powering structured DeFi products they are known for. Streamlining and automating their token vesting plans in a secure way would help them greatly cut down on needless admin time. Giving their contributors access to easily track and claim tokens was a must.

Traditional approaches to token vesting weren’t quite right:

Spreadsheet management and manual distributions: This approach is widely used by onchain orgs, but places a large burden on parts of the DAO to manage and distribute vested tokens. Automating the distribution and streamlining claiming would be a major improvement and was the primary goal.

Custom Vesting Smart contracts: Creating custom contracts is not the primary job of any onchain org. Building custom contracts is cumbersome and risk-prone. Using off-the-shelf contracts can help streamline the distribution, but becomes difficult for orgs to keep track of distributed vesting plans and even more difficult for recipients to manage vesting plans.

Participation in governance: While vesting tokens are often allocated to an organizations most dedicated contributors, these tokens are not able to participate in governance. Having flexibility to how and when these tokens can participate in Index Coops snapshot DAO governance is important.

Additionally, the pre-existing terms of token vesting plans meant that an onchain solution would only be sufficient if it could meet the existing criteria for how and when tokens met vesting criteria.

The Solution

Hedgey’s Token Vesting solution offered a simple, secure solution for Index Coop that allowed them to match the requirements of their vesting plan terms, while moving their contributor token vesting plans onchain.

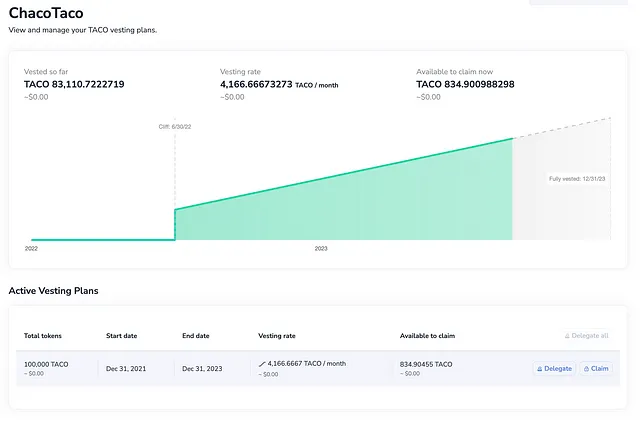

Directly from their Safe, Index Coop DAO was able to create onchain vesting plans for their DAO contributors using Hedgey. Once the plans were distributed, the DAO issuers instantly gained access to a custom dashboard to track and manage issued plans with ease. On the other side, vesting plan recipients gained instant access to their own dashboards where they can now track their vesting plan and claim vested tokens, saving the DAO countless hours every month in unessesary admin overhead.

All of this was done on Hedgey’s free, public goods platform.

Benefits of using Hedgey

Feature-complete tools to create the exact vesting plans you need.

Mass distribute vesting plans to 50+ recipients in a single transaction.

Instant access to feature-complete dashboards for issuers and recipients

Dedicated Safe app.

Audited by Consensys Diligence.

Full dashboard for finance teams to issue, track, and manage vesting plans.

Full dashboard for recipients to track and claim vested tokens.