Case Study: Collab.Land (Team Token Vesting & Investor Lockups)

The bedrock of every Discord community you’ve ever been a a part of, Collab.Land, is using Hedgey for its token vesting and investor lockups.

Launched in 2020, Collab.Land created token gating to give online communities on Discord the ability to connect with their real members like never before.

Today, they power over 50k communities and 8m members on Discord, allowing groups to manage, grow, and thrive. Collab.Land itself has evolved from its two crypto OG founders, Anjali and James Young, to a robust DAO with thousands of active members helping Collab.Land grow.

With the evolution into a DAO, a challenge around token distributions to key stakeholders emerged.

The Challenge:

Having already been established for years, Collab.Land launched their DAO in a public and transparent way. In launching, they needed to distribute tokens to DAO contributors and previous investors in a similar fashion; transparent, onchain, and automated way.

Additionally, the locked and vesting tokens needed to be Govenor Bravo compatible in order to participate in governance proposals via onchain voting on Tally.

Traditional approaches to token vesting would not do what Collab.Land needed.

Spreadsheet management and manual distributions: This was the opposite of what Collab.Land needed. The admin overhead, centralization, lack of governance participation for recipients, and ongoing risk in managing dozens of distributions were all reasons manual approaches to vesting would not work.

Custom Vesting Smart contracts: Creating custom contracts is not the primary job of any onchain org. Building custom contracts is cumbersome and risk-prone. Using off-the-shelf contracts can offset the distribution, but displaces that burden to the recipients of vesting plans on recipients.

Participation in governance: While vesting and locked tokens are often allocated to an organizations most dedicated contributors, these tokens are not able to easily participate in governance. Governance participation either directly or in delegating voting rights was core to the needs of Collab.Land.

Additionally, the pre-existing terms of token vesting plans meant that an onchain solution would only be sufficient if it could meet the existing criteria for how and when tokens met vesting criteria.

The Solution

Hedgey’s Token Vesting solution offered a simple, secure solution for Collab.Land that allowed them to match the requirements of their vesting plan terms for both contributor token vesting and investor lockups, while moving these plans onchain; allowing them to streamline operations, cut

admin overhead, and add on crypto-native governance to their vesting plans.

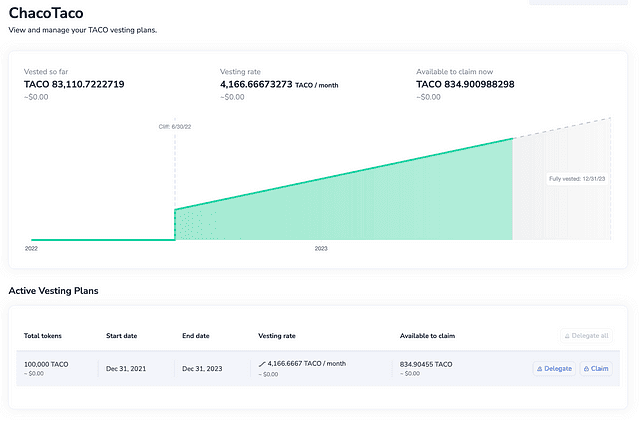

Directly from their Safe, Collab.Land was able to create and distribute onchain vesting plans and investor lockups via Hedgey. Once the distribution was completed, Collab.Land, gained instant access to track and manage their entire distribution across team and investor allocations. On the other side, recipients of vesting plans/ investor lockups gained instant access to their own dashboards where they can now track their token plan and claim vested tokens.

Additionally, Hedgey's core contracts enable these vesting and locked token alloations to participate in onchain governance via Tally. Collab.Land runs their community-wide onchain governance on Tally and by using Hedgey, Collab.Land is able to have their team vesting and investor tokens participate in delegation and voting.

All of this was done on Hedgey’s free, public goods platform.

Benefits of using Hedgey

Feature-complete tools to create the exact vesting plans you need.

Mass distribute vesting plans to 50+ recipients in a single transaction.

Instant access to feature-complete dashboards for issuers and recipients

Onchain and snapshot governance compatible.

Dedicated Safe app.

Audited by Consensys Diligence.

Full dashboard for finance teams to issue, track, and manage vesting plans.

Full dashboard for recipients to track and claim vested tokens.

If you’re manage vesting plans on a spreadsheet, planning an upcoming launch, or want to just chat through Hedgey, feel free to reach out on twitter, book some time to chat, or explore our app.