Hedgey is now a part of Anchorage Digital with the launch of HedgeyPro. Read More.

Hedgey is now a part of Anchorage Digital with the launch of HedgeyPro. Read More.

Token infrastructure for

onchain teams.

Token infrastructure

for onchain teams.

Token vesting, lockups, grants and distributions for your team, investors and community.

The best teams grow on Hedgey

Employee Token

Vesting

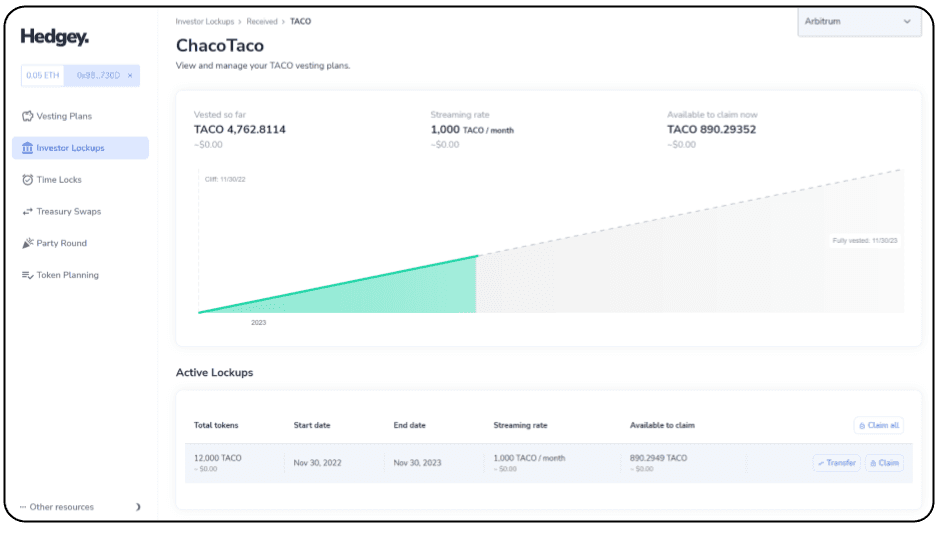

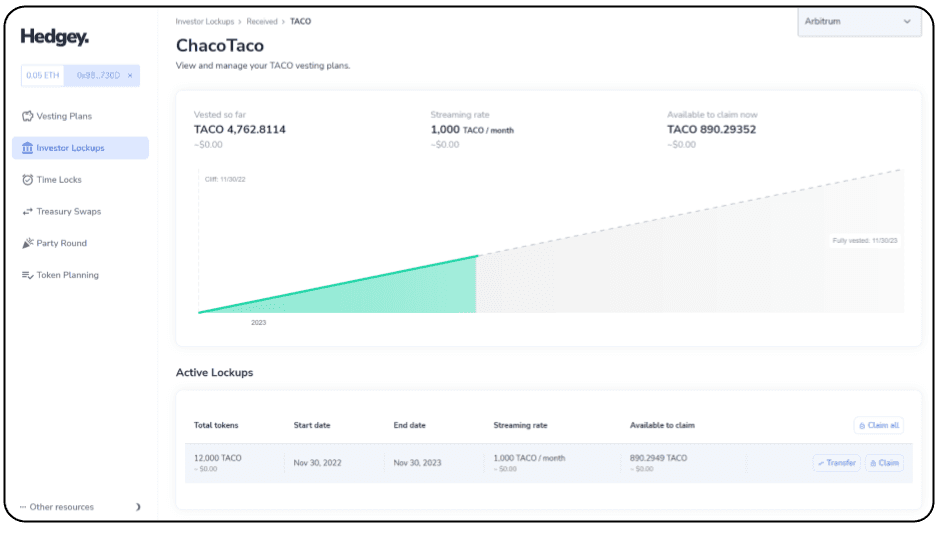

Employee Vesting & Investor Lockups.

Employee Vesting

Investor Lockups

Token Cap Table Management

Employe & Investor Portrals

Open App

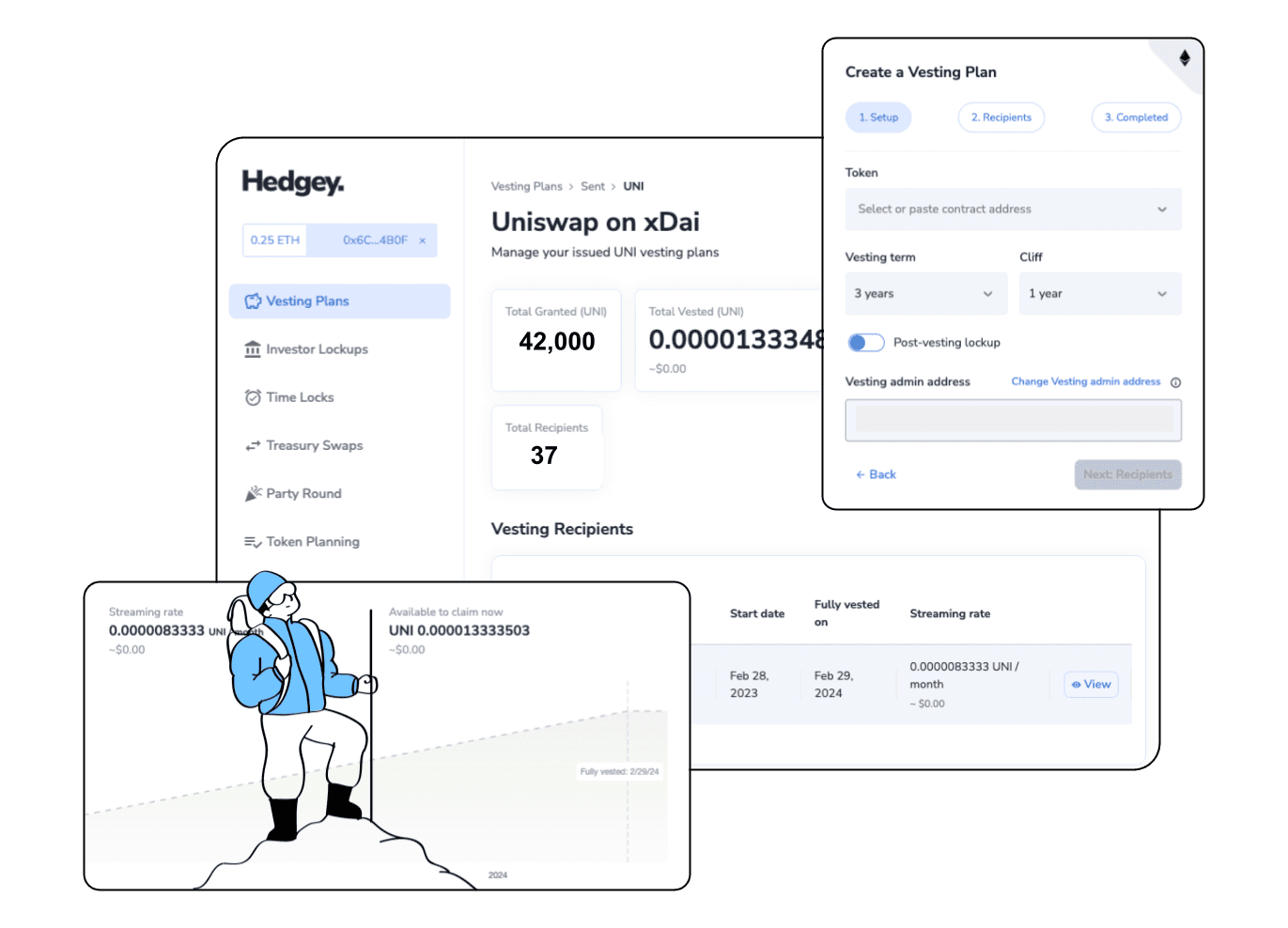

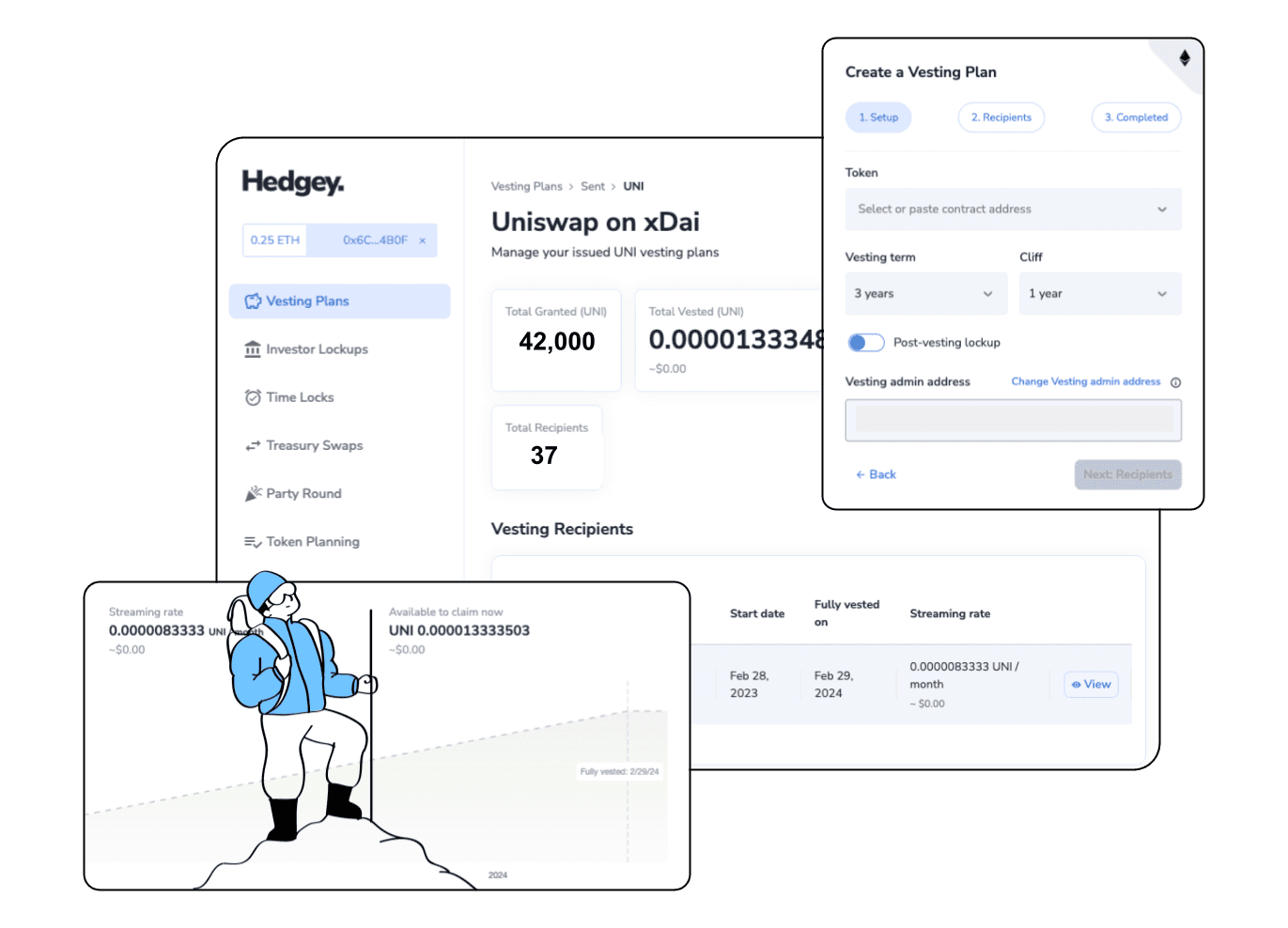

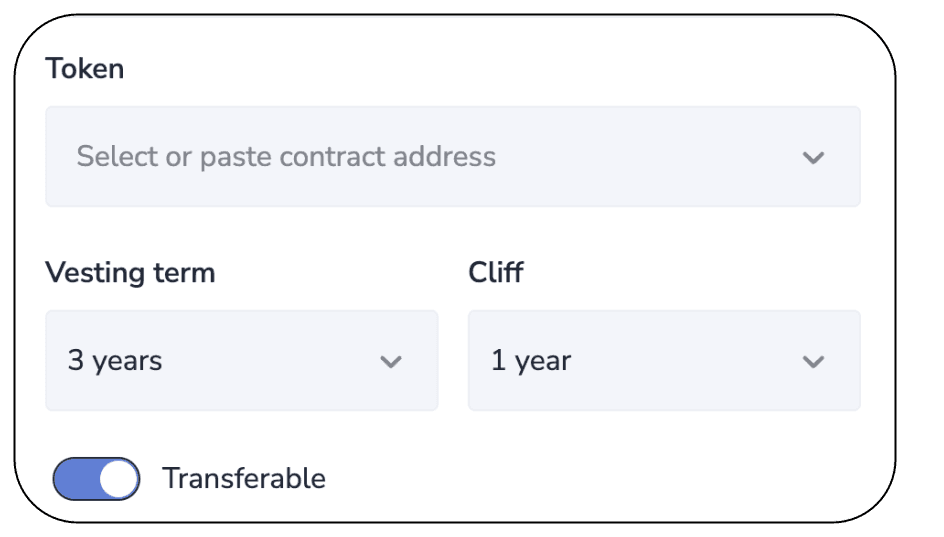

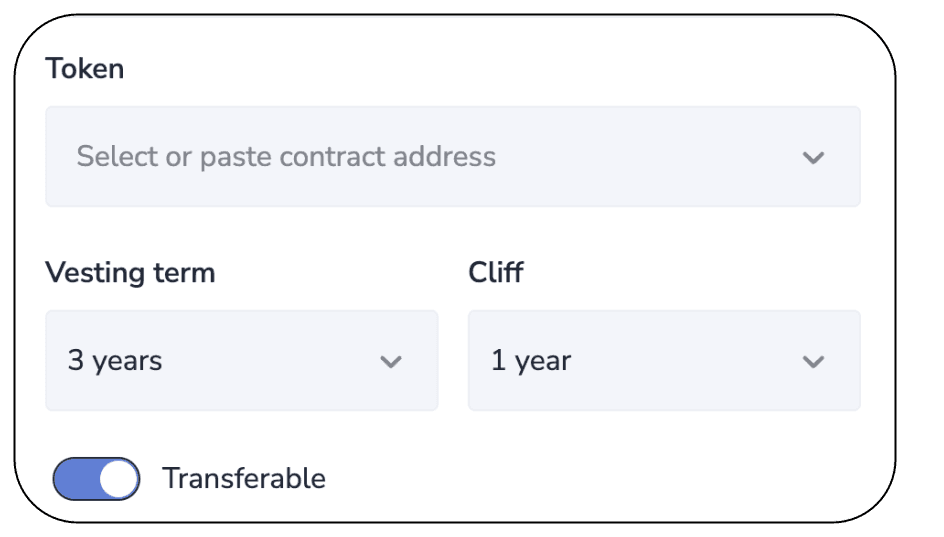

Create and automate

vesting plans for your

team in minutes.

Employee Token Vesting & Investor Lockups

Token vesting

Investor Lockups

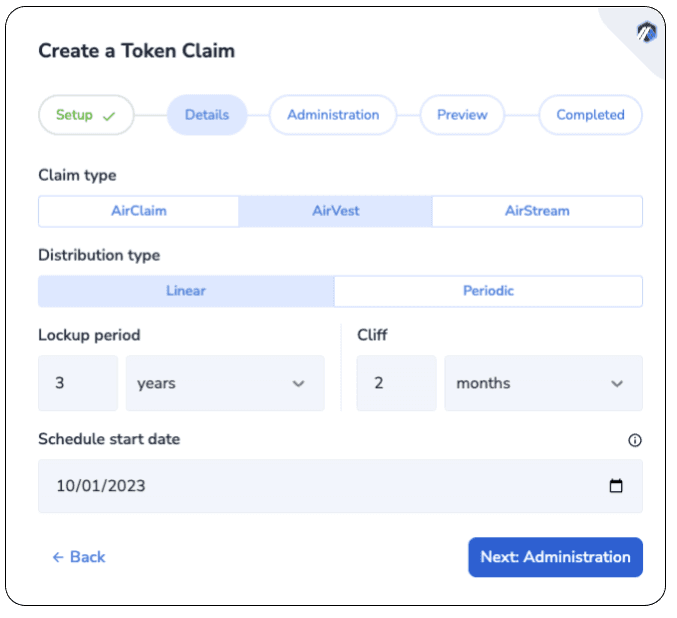

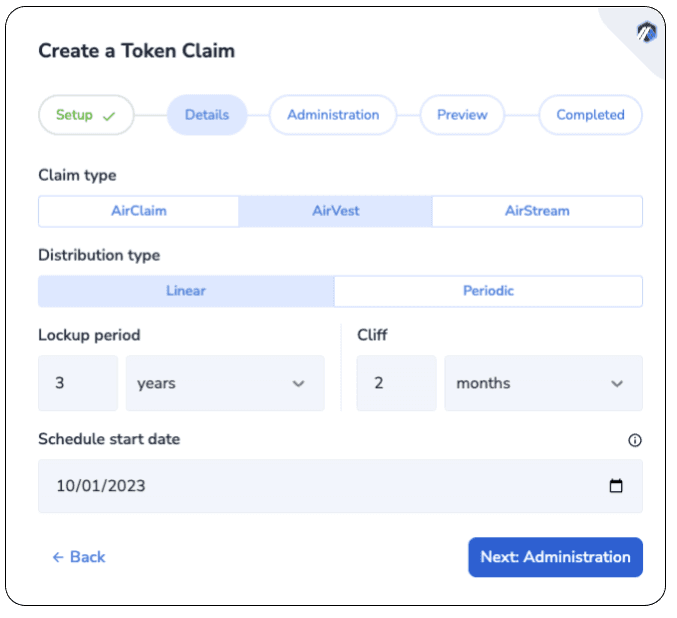

Airdrops & Claims

Hedgey PreToken

Learn More >

Open App

Create and automate

vesting plans for your

team in minutes.

Employee Token Vesting & Investor Lockups

Token vesting

Investor Lockups

Airdrops & Claims

Hedgey PreToken

Learn More >

What Our Users Are Saying

Brad Holden

Brad Holden

Protocol Labs

Protocol Labs

Hedgey is already lightyears ahead of older lockup systems and when you combine it with the investor dashboard we use to track and manage our unlocks, nothing else comes close.

Facundo Peláez

karpatkey

Hedgey is our go-to protocol whenever we need to coordinate a token swap between DAOs. Their platform has proven to be helpful in solving the trust component of OTC deals. The interface is simple and intuitive, and the team is very active and resourceful.

Facundo Peláez

karpatkey

Hedgey is our go-to protocol whenever we need to coordinate a token swap between DAOs. Their platform has proven to be helpful in solving the trust component of OTC deals. The interface is simple and intuitive, and the team is very active and resourceful.

Thomas Kwon

Celo Foundation

The best part about Hedgey is that it enabled our People Operations to self-serve a lot of the work that was previously done by the Finance team. The intuitive UI and tight integration with Safe enabled our teams to do more, better & faster, with less!

Willy Ogorzaly

Willy Ogorzaly

Shapeshift

Shapeshift

In a sea of tooling, nothing comes close to Hedgey. Their team takes time to understand the needs of DAOs and build thoughtful and effective solutions.

Thomas Kwon

Celo Foundation

Celo Foundation

The best part about Hedgey is that it enabled our People Operations to self-serve a lot of the work that was previously done by the Finance team. The intuitive UI and tight integration with Safe enabled our teams to do more, better & faster, with less!

Kyle Weiss

Gitcoin

Gitcoin has been incredibly impressed with the simplicity of the mechanisms Hedgy offers coupled with the power to make them incredibly valuable for our community. Hedgey cares about the outcomes we are trying to achieve and has met us where we are heading.

Kyle Weiss

Executive Director

Gitcoin Foundation

Gitcoin has been incredibly impressed with the simplicity of the mechanisms Hedgy offers coupled with the power to make them incredibly valuable for our community. Hedgey cares about the outcomes we are trying to achieve and has met us where we are heading.

Gabriel Anderson

Graph Paper Capital

There is simply no one else as good as them for giving pre-token companies the support, resources, and free tools to go live.

Gabriel Anderson

GPC

There is simply no one else as good as them for giving pre-token companies the support, resources, and free tools to go live.

Live Token Projects

Use our free, onchain token vesting tools to distribute tokens to your team, investors, and community. Create new plans in minutes and give every recipient a custom portal to track, claim, and manage their allocations.

Pre-token Projects

We've launched Hedgey PreToken to help pretoken companies prepare for token launches. Access streamlined workflows, tools to map out your token allocations, and secure systems to collect and distribute vesting to your team and investors.

Investors

Whether you're wanting a more effective way to support your pretoken companies, save time tracking your entire portfolio, or upgrade your investor unlocks, Hedgey has the tools you need.

Community & Team

Supercharge your biggest supporters with the industry leading system to receive, track, and interact with their token allocations.

Builder Ready

From pre-token to Unicorn and every stage between, Hedgey gives you access to the tools you need to bring your org to the next level.

Pre-Token Projects

We've launched Hedgey PreToken to help pretoken companies prepare for token launches. Access streamlined workflows, tools to map out your token allocations, and secure systems to collect and distribute vesting to your team and investors.

Live Token Projects

Get back time and save a ton of money using our free onchain vesting, investor lockups, and other core token tools that will help you focus less on admin jobs and more on building the future.

DAOs

Investors

Whether you're wanting a more effective way to support your pretoken companies, save time tracking your entire portfolio, or upgrade your investor unlocks, Hedgey has the tools you need.

Community & Team

Supercharge your biggest supporters with the industry leading system to issue vesting plans to your team and distribute time-locked tokens to your community.

Onchain is evolving. We help you keep up.

Give your vesting and lockups the functionality they need using our customizable voting, delegation, and core feature optimizations.

FAQ

FAQ

Do you support custom vesting and unlock schedules?

Hedgey's contracts allow for totally customizable schedules across all products. Additionally, users can add cliff dates, post vesting lockups, transferability, voting rights, and other core features specific to each product.

Are Hedgey contracts audited.

Yes. Our token vesting and lockup contracts are audited by Consensys Diligence. Hedgey has completed 5+ audits to date with leading auditing firms.

What networks do you support?

We support most Ethereum and most EVMs such as Arbitrum, Optimism, Base, Blast, Gnosis, Evmos, Polygon, Avalanche, Celo, OKXChain, Boba, Fantom, etc. Reach out to us on twitter if you need support for your network.

How do I get started using Hedgey?

Hedgey's onchain products are completely self-service. You can open the Hedgey app, connect your wallet and use the products freely. If you'd like support, reach out to us on telegram at @hedgeysupport to speak with someone 24/7 or book directly with our cofounder at https://calendly.com/lindseywinder/15min

You focus on building the future, we'll handle the rest.

Token

infrastructure

for onchain teams.

Token vesting, lockups, and distributions for your community, team and investors at every stage.

Plus hundreds more

Airdrops & Claims

Token Vesting Plans

Investor Lockups

What Our Users Are Saying

Brad Holden

Protocol Labs

Hedgey is already lightyears ahead of older lockup systems and when you combine it with the investor dashboard we use to track and manage our unlocks, nothing else comes close.

Facundo Peláez

karpatkey

Hedgey is our go-to protocol whenever we need to coordinate a token swap between DAOs. Their platform has proven to be helpful in solving the trust component of OTC deals. The interface is simple and intuitive, and the team is very active and resourceful.

Willy Ogorzaly

Shapeshift

In a sea of tooling, nothing comes close to Hedgey. Their team takes time to understand the needs of DAOs and build thoughtful and effective solutions.

Kyle Weiss

Gitcoin

Gitcoin has been incredibly impressed with the simplicity of the mechanisms Hedgey offers coupled with the power to make them incredibly valuable for our community. Hedgey cares about the outcomes we are trying to achieve and has met us where we are heading.

Gabriel Anderson

Graph Paper Capital

There is simply no one else as good as them for giving pre-token companies the support, resources, and free tools to go live.

Thomas Kwon

Celo Foundation

The best part about Hedgey is that it enabled our People Operations to self-serve a lot of the work that was previously done by the Finance team. The intuitive UI and tight integration with Safe enabled our teams to do more, better & faster, with less!